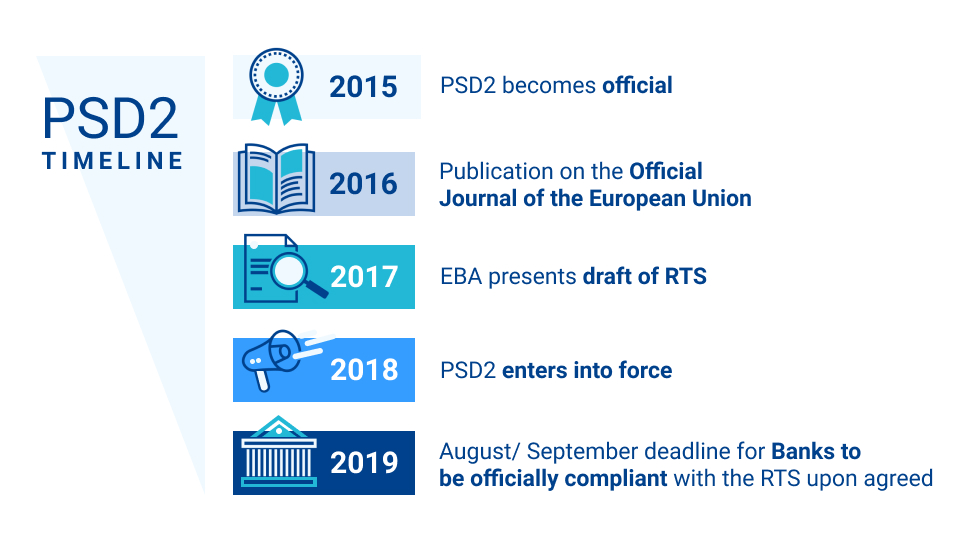

In 2018, Financial Institutions must be on all fronts complying with the regulations that will enter into force in the upcoming months. Among these, the revision of the Markets in Financial Instruments Directive (MiFID 2), the European General Data Protection Regulation (GDPR), the revision of the European Payment Service Directive (PSD2), which already entered into force exactly one month ago, on the 13rd January 2018. At the center of PSD2 there are the Regulatory Technical Standards (RTS) which define how FinTechs will connect to Banks. Nowadays, to access the Bank data of a customer, some FinTechs use screen scraping, a technique that uses Bank’s access codes but this is considered unsafe. However, the RTS will become applicable only in August or September 2019.

It is during those 18 months that Banks will launch their APIs allowing FinTech to connect to them. Nevertheless,

“We hope Banks will go faster than the horizon 2019, because we would like to test their APIs before”, hopes Jérôme Traisnel, CEO of SlimPay.

The following 18 months will be an intense period for Banks, that will proceed with the integration of APIs for several information systems enabling them to strengthen their applications and secure their systems. On the other hand, FinTechs are just waiting and looking forward to test these APIs and in case these tests resulted inconclusive, FinTech will then continue to do screen scraping.

Contrary, if Banks’ APIs will be available in September 2019, FinTechs will be able to connect to them and take major advantages than the current use of screen scraping. “APIs will allow us to have access to account information that might be relevant. For instance, when someone will pay with a credit card, we can create an automatism that verifies if he/she has enough money on his/her account. This will help us reduce the risks of unpaid/ non- payment”, says Jérôme Traisnel SlimPay’s CEO.

Jérôme Traisnel raises the questions of the content available by Banks’ APIs since

“With the screen scraping, we can do everything. We do not know if with the APIs we will have access to a portfolio of relevant information”, noted SlimPay’s CEO.

Unfortunately, it is not possible to know in advance if the APIs will give access to an interesting portfolio of information, only once Banks will be ready to share their APIs there will the moment of truth.