Due to the recent SEPA Rulebook changes different elements of the SEPA Direct Debit have changed (Rulebook latest updates – November 2017). The latest update of the Rulebook is mainly focused on SEPA Direct Debit B2B. As of common knowledge, two different types of SEPA Direct Debit schemes can be identified: the SEPA Direct Debit Core and Business-to-Business (B2B).

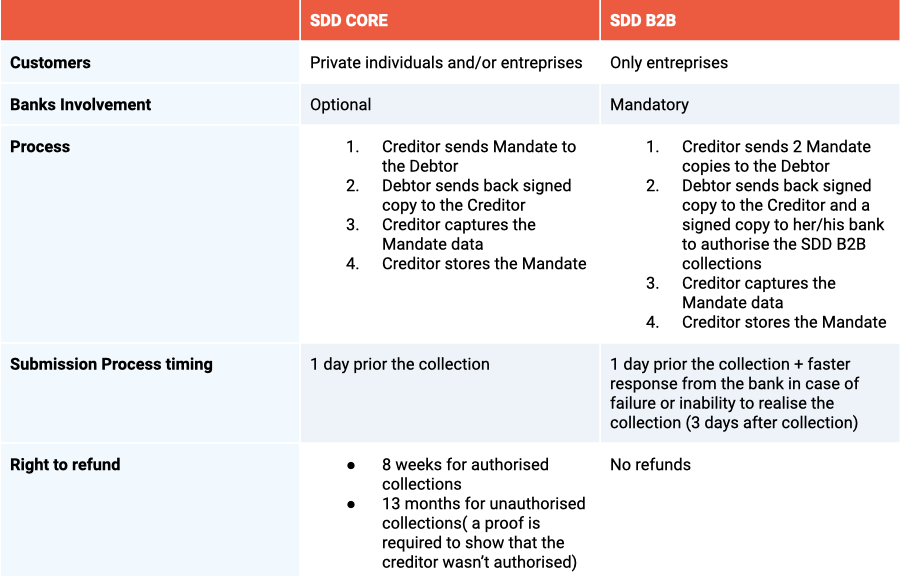

How do these schemes differ from each other?When should you use the SDD B2B Scheme? For a better understanding, let’s briefly identify the differences between SDD B2B and SDD CORE.

- The SDD B2B scheme can only be used when the debtor is an enterprise.

- The acceptance of the SDD B2B is not compulsory, consequently, some banks do not accept this type of direct debit.

- SDD B2B scheme requires the debtor to sign an agreement with the bank before any direct debit. Otherwise, if the debtor fails to notify their bank, the B2B Direct Debit will be rejected. *

- Faster response from the bank in case of failure or inability to realise the collection (3 days after collection).

- SEPA Direct Debit B2B customers are not entitled for refunds.

SEPA Direct Debit B2B Process

The Creditor sends 2 Mandate copies to The Debtor has to send to the Creditor a signed copy of the Mandate and send another signed Mandate or a separate agreement to his/her bank to authorise the account for B2B collections (both creditor and debtor bank accounts need to be flagged as B2B enabled). Then, the creditor captures the Mandate data and stores the Mandate.

Hereby a comparison representation of the key factors of the SEPA Direct Debit Schemes.

To conclude, the SEPA Direct Debit B2B can be considered more complicated from one country to another to implement than the SEPA Direct Debit CORE. Nevertheless, this SDD Scheme represents higher payment guarantees to the merchant.