To get started with SEPA Direct Debit, any company or institution needs to get a Creditor ID (CI). This CI identifies a Creditor independently from its relationship with any creditor bank. The CI is a standardised, unchanging and unique to each Creditor.

It also allows a debtor to:

– verify a SEPA Direct Debit transaction

– ask for a refund or initiate a dispute with the right Creditor

– check a mandate.

A SDD mandate is properly identified by the combination of a Creditor ID (CI) + a Unique Mandate Reference (UMR). It forms the unique SDD mandate key.

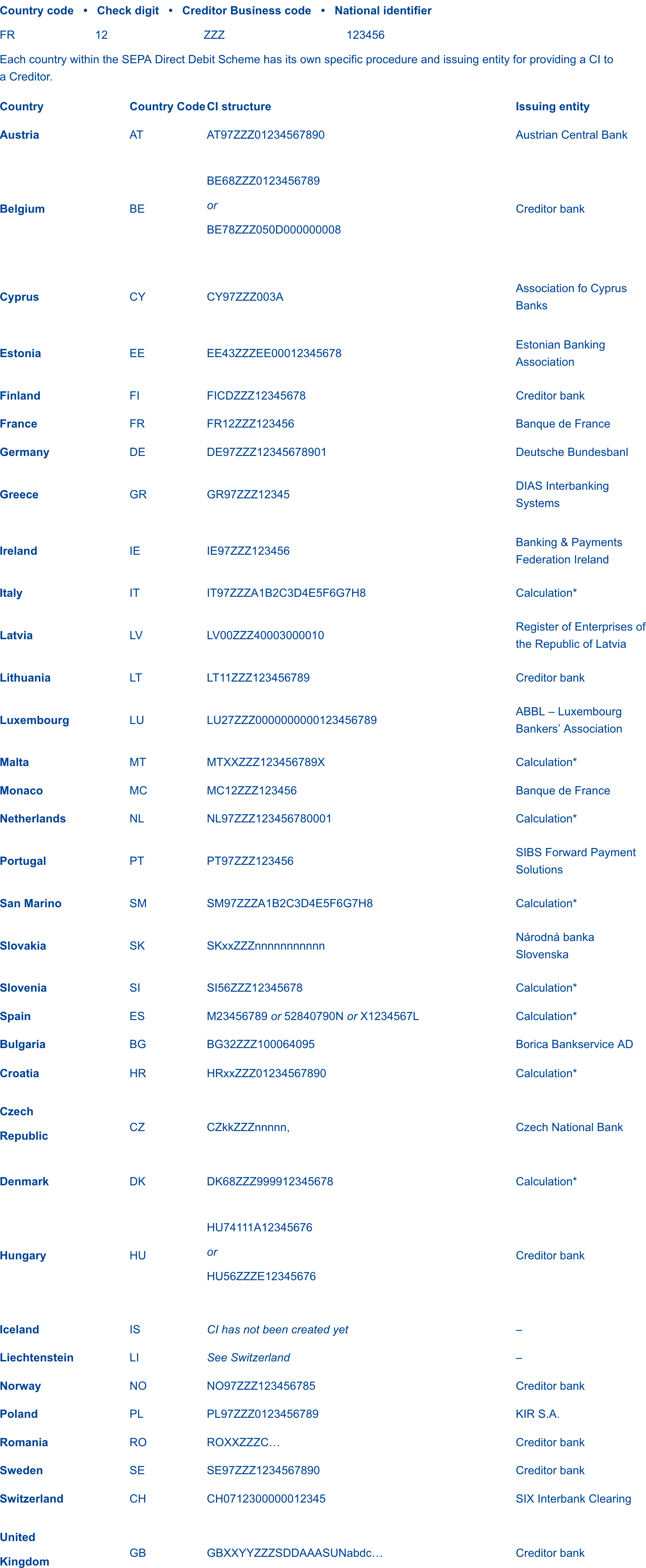

The CI structure may differ from one country to one another in the SEPA zone. The SEPA SDD Schemes allow the use of existing national identifiers to build a SEPA CI by adding a country code and a check digit.

The general structure of a CI is:

Country code • Check digit • Creditor Business code • National identifier

FR 12 ZZZ 123456

Each country within the SEPA Direct Debit Scheme has its own specific procedure and issuing entity for providing a CI to a Creditor.