Intro to Open Banking

Perhaps you’ve heard of Open Banking in recent months. Although not an entirely new concept, it is a financial service that is becoming more mainstream outside financial circles.

Open Banking is a highly-regulated way that consumers can share secure access to banking information, so that banks and financial institutions (lenders, payment service providers, etc.) can offer personalised services to them. Examples of these services include: budgeting, account aggregation, form filling, instant payments and more.

With Open Banking, banks, financial institutions open up their financial data to each other using application programming interfaces (APIs). Think of an API as a secure tunnel through which information is shared—between licensed players.

The important thing to remember is that the consumer must explicitly give consent to share their information. In turn, consumers have better control over their data and more choices in a competitive and innovative market of financial services.

More competition, more innovation

The main goals of Open Banking are to give consumers more power and choice in how they manage their finances, and to give banks and financial institutions the possibility to offer more tailored services to them, using their own data.

With banks having a considerable domination and influence over the financial world for decades, Open Banking also stimulates competition and allows startups, fintechs and smaller financial institutions to find innovative ways to use this data in order to compete.

Terminology

The term “open banking” is a generic term, with each market using their own terminology. For example:

- EU: Payment Services Directive 2 (PSD2)

- UK: Open Banking Standard

- US: Open banking (informal, as there is no regulatory body that officially oversees Open Banking in the US)

Open Banking in a nutshell

- Open Banking gives banks and financial institutions access to consumer data—but only if they have consented to it

- Open Banking is regulated at the European level, in the Payment Services Directive 2

- The main goal of Open Banking is to give consumers more control over their finances and allows banks and financial institutions to offer more tailored financial services

Open Banking Services

When we talk about Open Banking, there are commonly two services that are discussed:

Account Information Service (AIS)

This service shares account information, such as transaction history or current balance. Anyone who wishes to use AIS must be licensed to do so. A licensed third-party is called an Account Information Service Provider (AISP). The lengthy and intense process ensures that only very qualified, security-conscious companies have this status. SlimPay is an AISP, which is given by the French Prudential Supervision and Resolution Authority (ACPR), the governing authority for banking and insurance industries in France.

- How does it work?

AIS allows consumers to have a consolidated view of their finances. This is also called account aggregation. When consumers consent to this service, they can have all their financial data in one place.

This can also be used by AISPs to simply see certain pieces of information—for example, to verify if a customer has enough money in their account for a large purchase. Potential use cases for AIS would be budgeting, account verification, risk management, lending and many others.

Payment Initiation Service (PIS)

This service is especially important for merchants, as it allows a licensed third party to initiate a payment on behalf of the consumer. This third party is called a Payment Initiation Service Provider (PISP). Just like for AIS, anyone who wishes to initiate payments must have the proper licence. SlimPay, for example, is a PISP.

PISPs have been licensed to initiate a payment directly from a consumer’s bank account, whereas a merchant has not. By partnering with a PISP, merchants can provide these new open banking payments to their customers. Payment initiation has many benefits for both merchants and consumers, which are outlined below.

- How does it work?

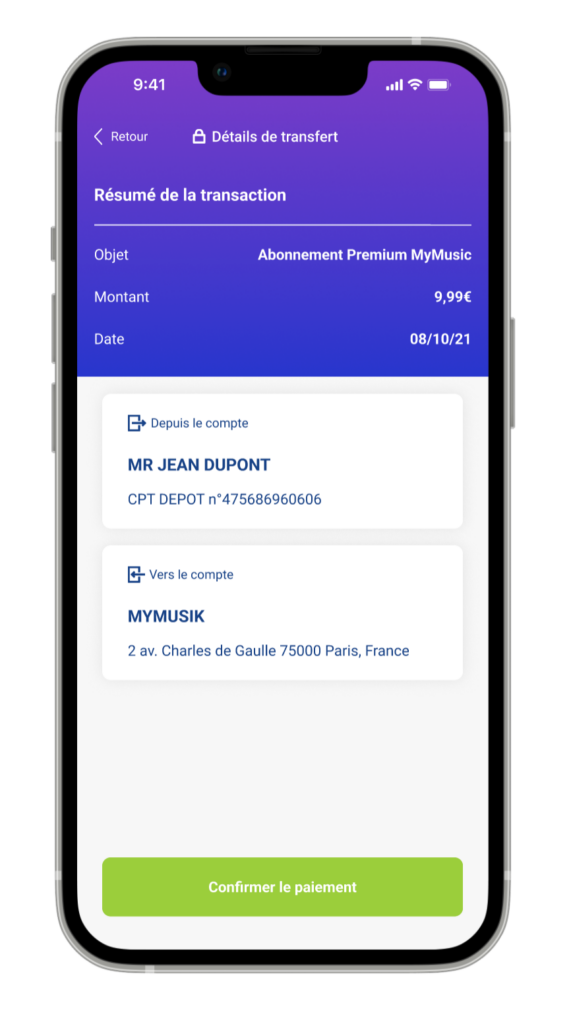

When a payment is initiated, this allows the PISP immediate, short-term access to the consumer’s account. Essentially, a screen pops up, which looks similar to a bank transfer you might make to send money to a contact. In reality, the technology behind PIS is different, but just like a transfer, a payment done with PIS is an account-to-account payment, which leaves the consumer’s account and arrives in the merchant’s account in a matter of seconds.

No sensitive information is shared when a consumer makes this type of payment. The consumer is simply approving the payment through their banking app, either with their secret code or biometric information (facial recognition, fingerprint). Their data stays in their banking app and is never shared with the merchant.

SlimCollect use case

As both an AISP and PISP, SlimPay can combine both services to create innovative use cases. Our Open Banking product, SlimCollect first uses AIS to collect the customer’s IBAN, and then PIS to take a first payment and enrol the customer in a recurring, Direct Debit plan.

Benefits of Open Banking Payments

For payments, Open Banking offers many benefits for both merchants and consumers.

Consumers

- User experience

Consumers today expect a smooth payment experience, with minimal steps, and a mobile-friendly design. Although Open Banking payments work on both desktop and mobile, they are optimised for mobile usage, which is a truly frictionless experience. This is especially important, as mobile payments are on the rise—up 30% since 2019.

There is no need to type in the card or account number, as in a normal transaction. The customer’s IBAN is automatically collected with the first payment. They simply approve the payment with their secret code or biometrics (facial recognition, fingerprint), and are then redirected back to the merchant’s site.

- Security

In focus groups carried out in 2022 by SlimPay, 60% of participants said they were about their security when making payments online. Similarly, in a 2021 study conducted by Pymnts, 55% of consumers surveyed do not store their payment details with merchants due to security concerns.

Open Banking payments are highly secure, as there is no intermediary—payments are sent directly from account to account. A consumer approves the payment in their banking app, instead of on an unfamiliar merchant site. (Even when making payments on desktop, the payment verification is often completed in one’s mobile banking app). And finally, the banking details are not stored on merchant sites—they stay securely with the consumer’s bank and are not shared with the merchant.

- Budgeting

With instant payments, there is no more waiting for debits to come out and constantly budgeting. Payments are instantaneous and clear in seconds.

Merchants

- Conversion

For any checkout experience, conversion is critical for businesses. Many consumers will exit a payment process early—the dreaded cart abandonment problem—because the process is tedious or takes too long, among other reasons.

Open Banking payments (payment initiation) are quick and go through the consumer’s banking app, which is familiar and increases conversion rates. The consumer simply approves the payment with their secret code or biometrics (facial recognition, fingerprint)—no need to type in their account or card number.

- Fraud

Payments that use Open Banking are highly secure, as every payment uses Strong Customer Authentication (SCA). Using the consumer’s banking app, there is much less room for fraud as they stay within a highly-secure environment. In the SlimCollect use case, the IBAN is automatically collected with the first payment via API, which leaves no room for a fraudster to enter an incorrect or fake IBAN. Not only does this improve the user experience, but merchants also can be assured that the IBAN is indeed the correct one, which significantly reduces fraud.

- Chargebacks / returns

Open Banking payments are irreversible, as they are done through a customer’s banking application which uses strong authentication. Chargebacks not only reduce profits, but also require more internal resources to manage them. Open Banking payments eliminate this problem, and give merchants more time to focus on their customer experience and product offering.

See SlimPay’s Open Banking payment solution in action: